1. Introduction: The Fragile Framework of Global Trade

The world economy runs on complex networks of trade agreements—WTO rules, FTAs, regional blocs like NAFTA (now USMCA), RCEP, and others. But beneath this cooperative surface lies a deeper, messier game: economic coercion, manipulation through debt, and the use of sanctions as modern warfare.

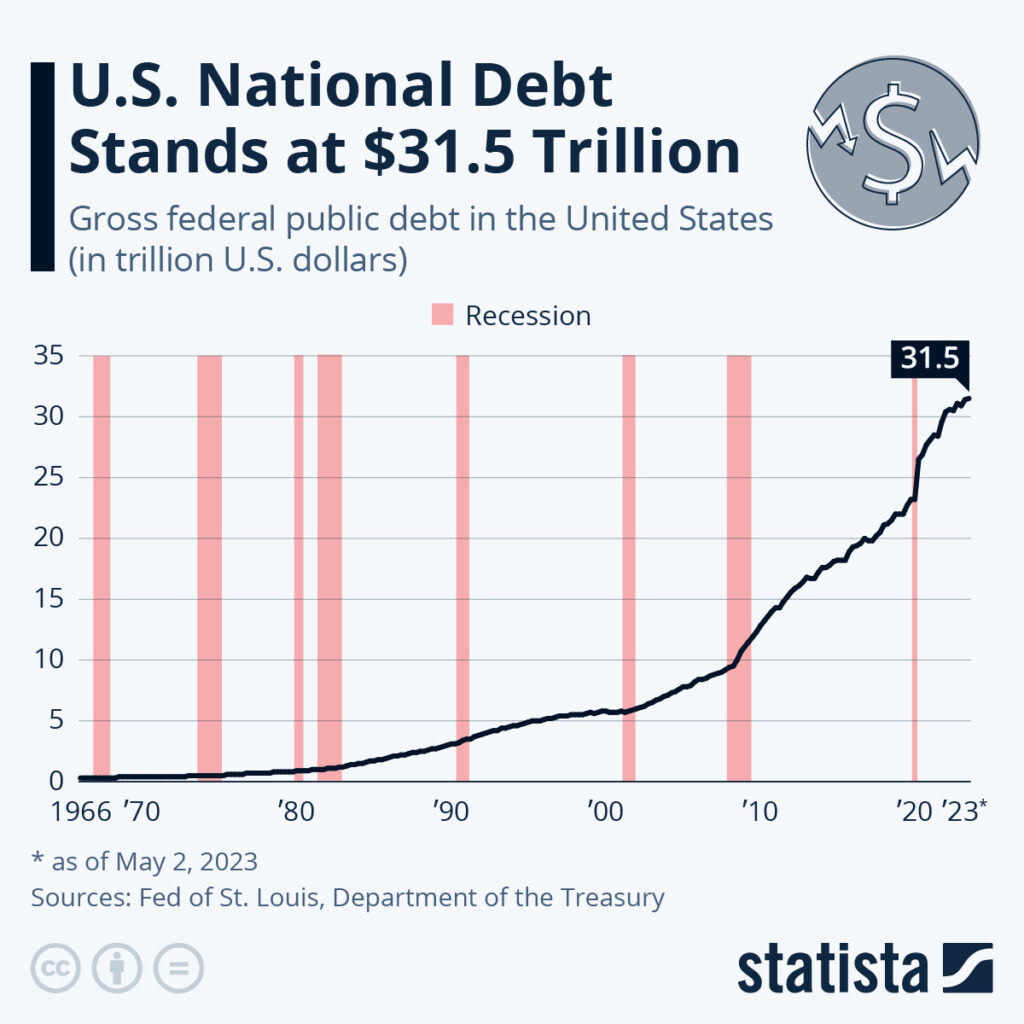

At the center of this tension is the United States, once the world’s unchallenged economic giant—now buckling under a national debt exceeding $34 trillion (as of 2025), and increasingly resorting to strategic sanctions and economic threats to hold onto its geopolitical leverage.

2. The U.S. Debt Crisis: An Empire Built on Borrowed Time

America’s $34+ trillion debt isn’t just a number—it’s a symptom of decades of military overreach, stimulus-fueled consumption, and unsustainable entitlement programs.

- Interest payments alone are nearing $1 trillion annually, surpassing military spending

- Foreign creditors like China and Japan are reducing their holdings of U.S. Treasuries

- Rising inflation, interest rate hikes, and dollar devaluation are causing global ripple effects

In simple terms, America’s economic dominance is now increasingly funded by printing more money—a luxury it enjoys only because of the U.S. dollar’s status as the global reserve currency.

3. Sanctions: America’s Economic Weapon of Choice

Unable to fight full-fledged wars in today’s globalized economy, the U.S. increasingly uses economic sanctions—against nations, banks, companies, and even individuals.

Recent examples include:

- Sanctions on Russia (SWIFT cutoff) post-Ukraine war

- Iran, facing economic strangulation since the Trump era

- Threats and tariffs on India, Turkey, China over defense or trade deals

- Secondary sanctions punishing countries that trade with U.S. “adversaries”

These sanctions bypass global consensus and rely on America’s control over:

- The SWIFT financial messaging system

- Dollar-based trade settlements

- Influence over global banking standards (via FATF, etc.)

While framed as “defending democracy,” this tactic often forces developing nations into compliance, disrupting local economies and undermining sovereignty.

4. Global Trade Agreements: A Web of Inequality

Agreements like WTO and NAFTA were built on Western terms. Even newer deals like CPTPP or USMCA serve U.S. interests disproportionately.

Problems include:

- Clause-based dominance: Provisions on intellectual property, e-commerce, or data storage are skewed toward tech giants in the West

- Protectionism disguised as liberalism: The U.S. demands open access to others’ markets while subsidizing its own industries (like agriculture, defense, and tech)

- Exit barriers and ISDS (Investor-State Dispute Settlements) that let corporations sue sovereign governments for changing laws affecting profits

Developing nations often enter these agreements under pressure or debt-based dependency (as with IMF/World Bank conditions), effectively losing policy flexibility.

5. BRICS+, De-dollarization & the Rise of Resistance

A growing number of nations are breaking from the dollar-centric model and forming new trade alliances:

- BRICS+ (Brazil, Russia, India, China, South Africa, + Egypt, Iran, UAE, etc.) is building an alternative trade and currency settlement framework

- Countries are experimenting with rupee-rial, yuan-ruble, and gold-backed clearing houses

- Moves toward bilateral and multilateral trade pacts that bypass the U.S. dollar and U.S. influence

This rise of multipolarity is both a response to and a threat against U.S. economic coercion.

6. What Should India and the Global South Do?

- Diversify Trade Alliances: Prioritize regional blocs like BIMSTEC, SCO, IORA over Western-dominated pacts

- Strengthen Indigenous Currencies: Promote rupee-based trade mechanisms with Africa, Central Asia, and ASEAN

- Avoid Debt Traps: Audit foreign loans (especially tied to infrastructure) and avoid IMF/World Bank dependency

- Defend Sovereignty in Policy Making: Reject trade clauses that hinder public health, agriculture reform, or data localization

- Educate the Public: Build awareness of how trade deals and sanctions shape fuel prices, inflation, and currency valuation

Conclusion: It’s Not Just Economics—It’s Geopolitical Chess

As the U.S. juggles internal debt chaos and external diplomatic strain, its reliance on sanctions and trade manipulation is likely to intensify. The Global South—India in particular—must remain vigilant, self-reliant, and strategic, refusing to be a pawn in this power game.

We must trade without surrendering, and grow without begging.

The future of fair global trade lies not in dependency—but in decentralized dignity.